Sterling Metals Expands Bornite Zone within Large Porphyry Copper System

January 15, 2026 – Toronto, Ontario – Sterling Metals Corp. (TSXV: SAG, OTCQB: SAGGF) (“Sterling” or the “Company”) is pleased to report new assay results from its expanded and completed 2025 drilling program at the Soo Copper Project (“Soo Copper” or the “Project”) located near Batchewana Bay, Ontario. These new results continue to expand a continuous zone of porphyry copper mineralization first highlighted earlier last year in MJ-25-01 which was later found to contain very high-grade bornite mineralization as previously reported in discovery hole MEPS-25-02 (see press release dated September 29, 2025).

Highlights

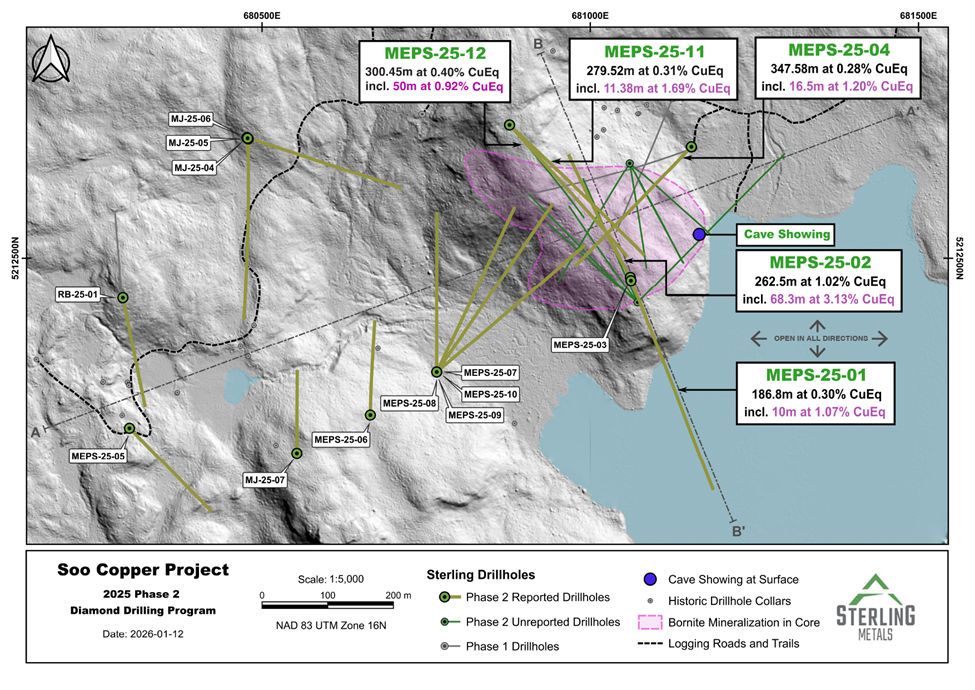

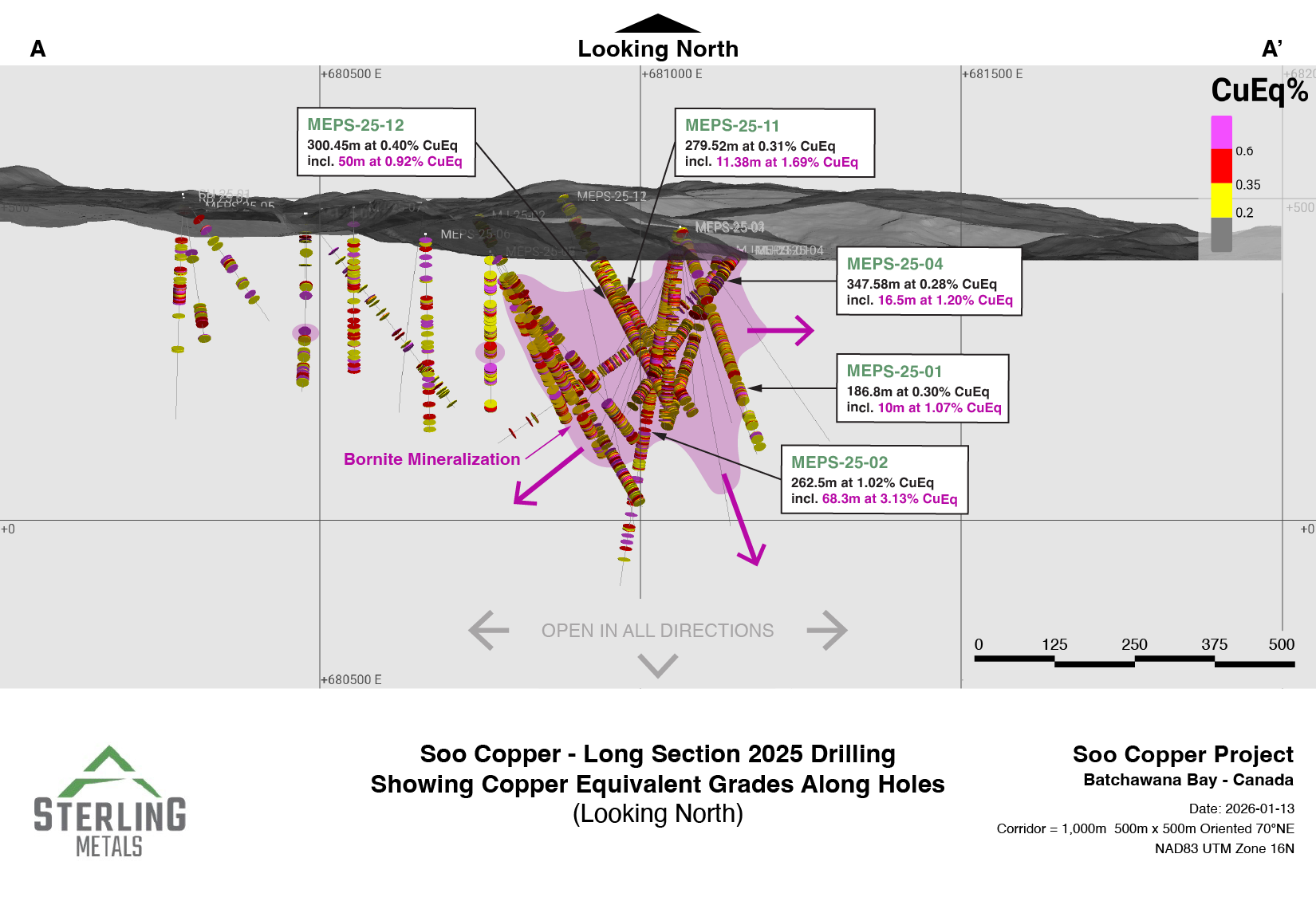

- MEPS-25-11 and MEPS-25-12 delivered wide and high-grade copper (Cu) intercepts consistent with the mineralization style discovered in MEPS-25-02 (see Table 1 for full results and Figures 4 and 5).

- MEPS-25-12 intersected 300.5m of 0.4% Copper Equivalent (CuEq) starting at 131.6m depth, including 50m of 0.92% CuEq starting at 315.5m depth.

- MEPS-25-11 intersected 279.5m of 0.31% CuEq starting at 135.2m depth, including 11.4m of 1.69% CuEq starting at 344.1m depth.

- Results further define a higher-grade bornite core within a continuously copper-mineralized 400m × 400m area that remains open to the east, south, and at depth. The interval of strongest bornite accumulation in MEPS-25-12 graded 2.42% CuEq across 10.0m starting from 343.0m depth (Figure 2).

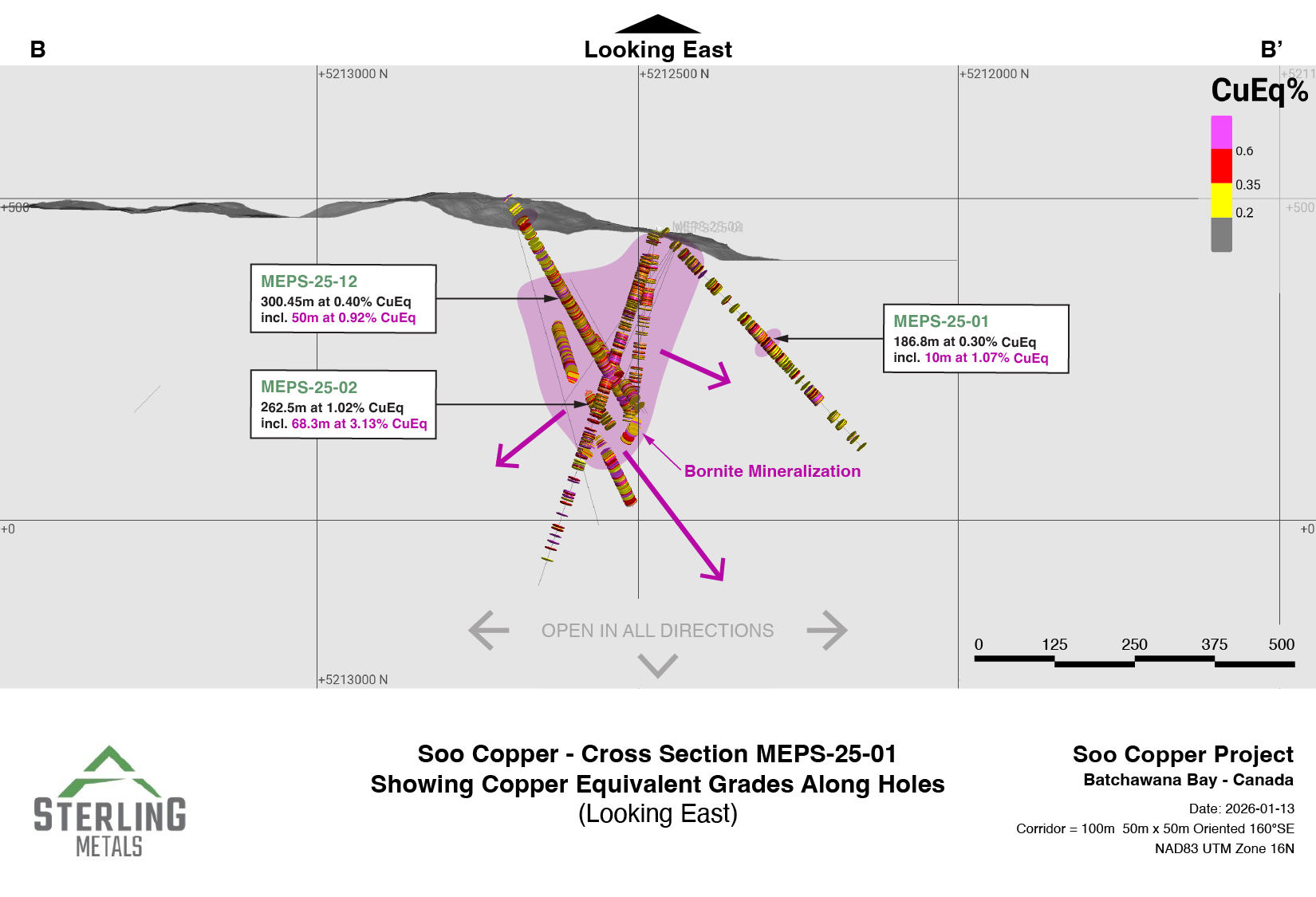

- MEPS-25-01 expanded the footprint of copper mineralization by approximately 300m to the south, opening a large untested area of near-surface potential while also intersecting a higher grade 10.0m interval grading 1% CuEq starting at 370.5m depth, confirming that the copper mineral system extends a long way to the south (Figure 3).

- Seven of the holes reported today tested the western extension of the system, within the broader 1,000m × 600m area evaluated in the 2025 program.

- Results released today represent 17 of 33 drillholes (6,267m) completed in 2025, including four holes previously released, with assays pending for 12 additional holes from the central core of the system. The majority of these pending results are from neighbouring drill holes within this emerging bornite zone and are expected to have a significant impact on the resource development potential and plans for 2026 follow-up drilling.

Mathew Wilson, CEO and Director, commented, “These latest results continue to demonstrate the scale and zonation of a large, mineralized porphyry system. They reinforce the importance of exploring both the broader system and the high-grade bornite discovery area to unlock additional new discoveries. We look forward to reporting the remaining assays from our 2025 drill program and to commencing our upcoming winter drill campaign next month, where we aim to rapidly advance our understanding of the system’s copper potential while fully leveraging the project’s excellent accessibility and existing infrastructure.”

Figure 1. Plan map of 2025 drilling and reported results on holes.

Figure 2: Long section of 2025 drilling and reported results on holes.

Figure 3: Cross section of highlight holes.

Building on the discovery made in MEPS-25-02, which confirmed a new style of high-grade copper-gold mineralization near surface, occurring approximately 200m south of the long, continuous copper interval in MJ-25-01 (see press release dated May 29, 2025), Sterling has demonstrated that the Soo Copper mineral system is substantially larger and richer than previously recognized, and that significant potential exists for an initial near-surface mineral resource that could be rapidly evaluated. Consequently, the Company accelerated its strategic plans by expanding the 2025 program, moving directly into a resource-exploration drilling program of the discovery area, and laying the foundation for a larger 2026 campaign.

MEPS-25-01 was drilled southwards away from the discovery area (Figure 3) and intercepted broad intervals of continuous porphyry copper style mineralization (e.g., 186.6m of 0.26% Cu including 26.8m of 0.58% CuEq) that extend a long way into a previously untested area to the south. This newly defined corridor of continuous copper-gold mineralization as well as a higher grade 10.0m interval grading 1.07% CuEq starting at 370.5m depth, opens up a large new zone that will be one focus of the Company’s 2026 drill program.

It is thought that MEPS-25-02 drilled through the high grade bornite copper zone into a lower grade molybdenum-copper zone, demonstrating the presence of a large, metal zoned porphyry system. The high-grade zone crossed in MEPS-25-02 is still wide open to the east, south and at depth.

Drilling to the west of the MEPS discovery successfully followed the 1km long resistivity low corridor and corresponding soil geochemical trend, testing a 500m wide section of this structural geophysical target. Holes in this western area generally intersected broad intervals of copper mineralization dominated by chalcopyrite, with increasing pyrite and pyrrhotite content toward the west. Within this 1km by 500m drill window, the strongest copper grades continued to occur to the east, anchoring the centre of the bornite zone outlined earlier in the 2025 program.

A fan of drill holes (MEPS-25-07, 08, 09, and 10) completed in a valley directly west of the discovery area all intersected bornite, with holes closer to the discovery centre, particularly 07, 09, and 10, returning the widest intervals. These results extend the footprint of the bornite zone by approximately 250m to the west and demonstrate that the valley hosts the potential for both wide zones of copper mineralization and locally high-grade intervals. Holes MEPS-25-08 and MEPS-25-09 each returned high-grade copper hosted in chalcopyrite and associated with magnetite rich M-veins, including 0.25 m grading 9.28% CuEq in MEPS-25-08 and 0.30 m grading 15.73% CuEq in MEPS-25-09.

The valley holes also intersected extensive faulting, which appears to play an important role in localizing high-grade mineralization within the system. This structural preparation, combined with the continuation of bornite and high-grade copper farther west than previously demonstrated, provides a compelling new target corridor for follow-up drilling in 2026.

To date, 117 new samples returned assays exceeding 1.0% Cu from drill holes completed after discovery hole MEPS-25-02, demonstrating the potential for the nearby discovery of additional high-grade zones that will impact the resource development potential which has become an important focus of the Company. Additional assays from logged copper-mineralized drill intercepts remain pending and will be disclosed in a subsequent news release.

The Company continues target development work of additional copper mineralization centres across the property, including the Gimlet target (see press release dated October 8, 2025), where initial drill testing will be part of the 2026 drill program.

Jeremy Niemi, SVP Exploration, commented, “The combination of broad copper mineralization in MEPS-25-01 and the high-grade zones discovered in MEPS-25-02 made it clear that our copper system warranted a faster, more aggressive drilling approach. That’s why we expanded our 2025 program and are preparing for a significantly larger 2026 resource exploration drill program. The 117 new samples over 1.0% copper — outside the original discovery area — illustrate that high-grade domains are emerging across multiple parts of the system.”

Dr. Neil O’Brien, Chief Geologist, commented, “Drilling has indicated that the bornite-rich copper-gold mineralization is closely associated with the presence of the earliest porphyry (“GFP”) dykes with the grades generally increasing towards the contacts with these dykes. While these mineralized GFP dykes have been intercepted in the majority of drillholes, some holes intercepting multiple dykes, additional drilling is required to establish the preferred orientation of these dykes and therefore the orientation of the very high-grade bornite mineralization. However, the drilling has confirmed that a broad halo of continuous bornite-chalcopyrite copper mineralization exists between, and away from these dykes, allowing for the potential development of a mineral resource that comes to surface.”

Figure 4. Massive chalcopyrite mineralization in MEPS-25-11 at 349.55m grading 13.1% Cu, 0.2 g/t Au, 22 g/t Ag and 340 ppm Mo

Figure 5. Bornite and chalcopyrite mineralization in MEPS-25-12 at 348.2m grading 8.2% Cu, 4.86 g/t Au, 71.4 g/t Ag and 20 ppm Mo

Table 1. Significant Assay Intervals

| Drillhole | Zone | From (m) |

To (m) |

Length (m) |

Cu (%) |

Mo (ppm) |

Au (g/t) |

Ag (g/t) |

CuEq (%) |

| MEPS-25-01 | Central | 3.9 | 484 | 480.1 | 0.17 | 4.3 | 0.016 | 0.79 | 0.20 |

| Including | 194.7 | 381.5 | 186.63 | 0.26 | 3.6 | 0.022 | 1.12 | 0.30 | |

| Including | 213 | 260.5 | 47.5 | 0.40 | 4.1 | 0.019 | 1.77 | 0.44 | |

| Including | 254 | 260.5 | 6.5 | 0.64 | 3.9 | 0.032 | 1.87 | 0.70 | |

| Including | 354.7 | 381.5 | 26.8 | 0.48 | 8.5 | 0.088 | 1.34 | 0.58 | |

| Including | 370.5 | 380.5 | 10 | 0.87 | 17.6 | 0.19 | 2.35 | 1.07 | |

| MEPS-25-02 | Central | 5 | 341 | 336 | 0.43 | 43.5 | 0.39 | 2.75 | 0.83 |

| Including | 47.5 | 310 | 262.5 | 0.52 | 46.6 | 0.49 | 3.15 | 1.02 | |

| Including | 179.72 | 248 | 68.28 | 1.39 | 71 | 1.83 | 8.46 | 3.13 | |

| Including | 181.25 | 181.65 | 0.4 | 13.3 | 3 | 1.03 | 22.9 | 14.5 | |

| Including | 215.6 | 224.75 | 9.15 | 6.8 | 80.6 | 13.2 | 46.26 | 18.92 | |

| Including | 219.85 | 220.45 | 0.6 | 21.3 | 2 | 196 | 168 | 193.85 | |

| Including | 220.45 | 221 | 0.55 | 33 | 2 | 0.342 | 210 | 36.04 | |

| And | 341 | 461 | 120 | 0.06 | 460.1 | 0.008 | 0.57 | 0.31 | |

| MEPS-25-03 | Central | 1.12 | 318 | 316.88 | 0.16 | 33.1 | 0.017 | 0.5 | 0.20 |

| Including | 78.25 | 147 | 68.75 | 0.28 | 13 | 0.023 | 0.89 | 0.32 | |

| Including | 98.25 | 125 | 26.75 | 0.45 | 14.3 | 0.037 | 1.49 | 0.51 | |

| Including | 105 | 111 | 6.0 | 0.94 | 7.3 | 0.079 | 3.86 | 1.06 | |

| MEPS-25-04 | Central | 12.42 | 360 | 347.58 | 0.20 | 75.9 | 0.022 | 1.42 | 0.28 |

| Including | 14 | 35 | 21 | 0.37 | 126.1 | 0.058 | 2.04 | 0.52 | |

| Including | 162 | 328 | 166 | 0.30 | 18 | 0.029 | 2.23 | 0.36 | |

| Including | 220.5 | 237 | 16.5 | 0.97 | 34 | 0.091 | 10.07 | 1.20 | |

| Including | 231.5 | 237 | 5.5 | 1.62 | 21.4 | 0.16 | 20.14 | 2.03 | |

| Including | 231.5 | 231.75 | 0.25 | 8.31 | 0.5 | 0.39 | 75.3 | 9.64 | |

| Including | 233.5 | 236 | 2.5 | 2.27 | 13.5 | 0.26 | 34.94 | 2.96 | |

| MEPS-25-05 | West | 1.25 | 252 | 250.75 | 0.06 | 1.4 | 0.010 | 0.34 | 0.08 |

| Including | 49 | 51.7 | 2.7 | 0.58 | 0.5 | 0.035 | 2.78 | 0.65 | |

| Including | 190.77 | 191.23 | 0.46 | 2.15 | 6 | 0.2 | 9.9 | 2.45 | |

| MEPS-25-06 | West | 4.7 | 337 | 332.3 | 0.08 | 2.3 | 0.009 | 0.34 | 0.10 |

| Including | 151.3 | 151.5 | 0.2 | 1.95 | 8 | 0.21 | 7.6 | 2.24 | |

| Including | 221 | 223 | 2 | 0.48 | 4 | 0.038 | 1.35 | 0.54 | |

| MEPS-25-07 | Central | 0.8 | 418 | 417.2 | 0.13 | 22.1 | 0.017 | 0.72 | 0.16 |

| Including | 156 | 383.4 | 227.4 | 0.18 | 12.6 | 0.021 | 1.08 | 0.22 | |

| Including | 335 | 383.4 | 48.4 | 0.32 | 38.5 | 0.043 | 1.89 | 0.40 | |

| Including | 335.6 | 340 | 4.4 | 0.94 | 128.8 | 0.089 | 4.99 | 1.15 | |

| MEPS-25-08 | Central | 0.61 | 348 | 347.39 | 0.14 | 2.7 | 0.015 | 0.52 | 0.16 |

| Including | 51 | 283 | 232 | 0.19 | 3 | 0.020 | 0.65 | 0.22 | |

| Including | 51 | 86 | 35 | 0.20 | 0.8 | 0.036 | 0.6 | 0.24 | |

| Including | 251.75 | 283 | 31.25 | 0.60 | 4.1 | 0.019 | 1.51 | 0.64 | |

| Including | 251.75 | 259 | 7.25 | 1.41 | 8.9 | 0.035 | 3.31 | 1.49 | |

| Including | 251.75 | 254.36 | 2.61 | 3.17 | 8.2 | 0.073 | 6.95 | 3.33 | |

| Including | 251.75 | 252 | 0.25 | 8.82 | 0.5 | 0.24 | 19.3 | 9.28 | |

| Including | 274 | 281 | 7 | 0.87 | 2 | 0.035 | 2.13 | 0.93 | |

| MEPS-25-09 | Central | 3.04 | 381.2 | 378.16 | 0.14 | 7.8 | 0.011 | 0.56 | 0.16 |

| Including | 125.86 | 381.2 | 255.34 | 0.18 | 11.3 | 0.013 | 0.68 | 0.21 | |

| Including | 223 | 270 | 47 | 0.42 | 31.1 | 0.020 | 1.08 | 0.47 | |

| Including | 223 | 227 | 4 | 0.91 | 10.8 | 0.037 | 2.09 | 0.97 | |

| Including | 255.7 | 270 | 14.3 | 0.62 | 90.3 | 0.026 | 1.36 | 0.71 | |

| Including | 255.7 | 256 | 0.3 | 14.9 | 4 | 0.56 | 26.6 | 15.73 | |

| Including | 346 | 365.15 | 19.15 | 0.34 | 8 | 0.020 | 1.37 | 0.38 | |

| MEPS-25-10 | Central | 1.55 | 444 | 442.45 | 0.12 | 16.3 | 0.017 | 0.6 | 0.16 |

| Including | 45.5 | 86 | 40.5 | 0.16 | 1.1 | 0.032 | 0.62 | 0.20 | |

| Including | 68 | 73 | 5 | 0.56 | 0.5 | 0.032 | 1.78 | 0.61 | |

| Including | 221 | 402 | 181 | 0.18 | 9 | 0.020 | 0.89 | 0.21 | |

| Including | 373 | 402 | 29 | 0.27 | 19 | 0.047 | 1.33 | 0.34 | |

| Including | 393 | 397.6 | 4.6 | 0.68 | 6.1 | 0.18 | 3.25 | 0.88 | |

| MEPS-25-11 | Central | 2.05 | 441 | 438.95 | 0.19 | 22 | 0.026 | 1.12 | 0.24 |

| Including | 135.23 | 414.75 | 279.52 | 0.25 | 25.1 | 0.034 | 1.39 | 0.31 | |

| Including | 336.75 | 355.5 | 18.75 | 0.98 | 33.6 | 0.12 | 4.93 | 1.17 | |

| Including | 344.12 | 355.5 | 11.38 | 1.42 | 39.7 | 0.18 | 6.63 | 1.69 | |

| Including | 349.55 | 349.83 | 0.28 | 13.1 | 338 | 0.2 | 22 | 13.74 | |

| Including | 410.3 | 414.1 | 3.8 | 0.72 | 90.3 | 0.11 | 4.28 | 0.91 | |

| MEPS-25-12 | Central | 2.15 | 438 | 435.85 | 0.24 | 53.8 | 0.035 | 1.32 | 0.31 |

| Including | 131.55 | 432 | 300.45 | 0.30 | 69.7 | 0.046 | 1.67 | 0.40 | |

| Including | 131.55 | 409.15 | 277.6 | 0.32 | 73.5 | 0.048 | 1.75 | 0.42 | |

| Including | 177 | 183.89 | 6.89 | 1.10 | 57.1 | 0.18 | 4.82 | 1.35 | |

| Including | 315.46 | 365.35 | 49.89 | 0.67 | 150 | 0.12 | 4.37 | 0.92 | |

| Including | 343 | 358 | 15 | 1.46 | 151 | 0.32 | 9.63 | 1.95 | |

| Including | 343 | 352.9 | 9.9 | 1.81 | 155.8 | 0.43 | 11.84 | 2.42 | |

| Including | 343 | 349.2 | 6.2 | 2.56 | 236.9 | 0.67 | 17.75 | 3.49 | |

| Including | 346.8 | 349.2 | 2.4 | 4.92 | 377 | 1.62 | 38.42 | 7.02 | |

| Including | 348.2 | 348.7 | 0.5 | 8.62 | 18 | 4.86 | 71.4 | 13.79 | |

| Including | 391 | 395 | 4 | 1.06 | 43.1 | 0.14 | 6.05 | 1.29 | |

| MJ-25-04 | West | No Significant Results | |||||||

| MJ-25-05 | West | 255.4 | 255.7 | 0.3 | 1.09 | 0.5 | 0.11 | 5.1 | 1.25 |

| Including | 340.6 | 363 | 22.4 | 0.14 | 2.5 | 0.011 | 0.67 | 0.16 | |

| Including | 348.7 | 349.05 | 0.35 | 1.26 | 0.5 | 0.06 | 3.3 | 1.36 | |

| MJ-25-06 | West | 5 | 390 | 385 | 0.066 | 2.1 | 0.015 | 0.54 | 0.09 |

| Including | 74 | 75 | 1 | 0.019 | 0.5 | 2.57 | 0.3 | 2.26 | |

| Including | 168.7 | 182 | 13.3 | 0.19 | 4.4 | 0.018 | 0.78 | 0.21 | |

| Including | 168.7 | 169.2 | 0.5 | 2.03 | 32 | 0.11 | 3.7 | 2.19 | |

| Including | 302 | 323 | 21 | 0.15 | 1.4 | 0.012 | 0.57 | 0.17 | |

| MJ-25-07 | West | 2.45 | 288 | 285.55 | 0.09 | 4.7 | 0.01 | 0.41 | 0.11 |

| Including | 28.8 | 29.3 | 0.5 | 1.36 | 5 | 0.054 | 4.5 | 1.47 | |

| Including | 80 | 141.5 | 61.5 | 0.15 | 2.3 | 0.012 | 0.55 | 0.17 | |

| Including | 218 | 288 | 70 | 0.12 | 9.7 | 0.012 | 0.54 | 0.14 | |

| Including | 277 | 277.25 | 0.25 | 1.47 | 2 | 0.13 | 2.6 | 1.61 | |

| RB-25-01 | Richards | 3 | 279 | 276 | 0.05 | 2 | 0.009 | 0.3 | 0.06 |

| Including | 105.45 | 105.7 | 0.25 | 1.1 | 3 | 0.044 | 4.7 | 1.2 | |

| Including | 243 | 248 | 5 | 0.2 | 4.4 | 0.014 | 0.86 | 0.23 | |

Intervals may not represent true widths which are not yet known and capping has not been applied to grades. CuEq grade calculations for reporting assumes spot metal prices January 8, 2026 metal prices of US$5.81/lb Cu, US$32.12/lb Mo, US$4452/oz Au and US$78.14/oz Ag and recoveries of 90% Cu, 85% Mo, 70% Au, 60% Ag. Recoveries used are from recent test work on the Solaris, Warintza Project in Ecuador which is a similar style mineralization to Soo Copper. See “Mineral Resource Estimate Update - NI 43-101 Technical Report, Warintza Project, Ecuador” with an effective date of July 1, 2024, and available on SEDAR+ under Solaris Resources profile.

Table 2. Hole locations, directions and final depths.

| Hole number | Easting | Northing | Elevation | Depth | Dip | Azimuth |

| CH-25-01 | 680,287 | 5,212,436 | 507 | 375 | -70 | 0 |

| MEPS-25-01 | 681,062 | 5,212,466 | 455 | 484 | -45 | 158 |

| MEPS-25-02 | 681,061 | 5,212,471 | 457 | 597 | -70 | 330 |

| MEPS-25-03 | 681,061 | 5,212,471 | 457 | 318 | -80 | 330 |

| MEPS-25-04 | 681,154 | 5,212,669 | 421 | 360 | -46 | 224 |

| MEPS-25-05 | 680,298 | 5,212,241 | 488 | 252 | -45 | 135 |

| MEPS-25-06 | 680,665 | 5,212,261 | 446 | 337 | -65 | 360 |

| MEPS-25-07 | 680,766 | 5,212,326 | 419 | 418 | -45 | 50 |

| MEPS-25-08 | 680,766 | 5,212,326 | 419 | 348 | -45 | 360 |

| MEPS-25-09 | 680,766 | 5,212,326 | 419 | 381.2 | -44 | 25 |

| MEPS-25-10 | 680,766 | 5,212,326 | 419 | 444 | -45 | 35 |

| MEPS-25-11 | 680,877 | 5,212,702 | 504 | 441 | -49 | 133 |

| MEPS-25-12 | 680,877 | 5,212,702 | 504 | 438 | -52 | 138 |

| MJ-25-03 | 681,125 | 5,212,744 | 421 | 354 | -53 | 199 |

| MJ-25-04 | 680,478 | 5,212,682 | 477 | 102 | -80 | 180 |

| MJ-25-05 | 680,479 | 5,212,681 | 477 | 390 | -45 | 180 |

| MJ-25-06 | 680,477 | 5,212,683 | 477 | 390 | -50 | 107 |

| MJ-25-07 | 680,553 | 5,212,203 | 487 | 288 | -65 | 360 |

| RB-25-01 | 680,288 | 5,212,439 | 501 | 279 | -53 | 168 |

Sampling Procedures – Quality Assurance/Quality Control

Analytical services were provided by Actlabs, which is an independent, CALA- and SCC-accredited analytical services firm registered to ISO 17025 and ISO 9001 standard. Drill core samples were logged and split in half with a diamond core saw. Half-core samples were securely stored at the core logging facility until being delivered to Actlabs Thunder Bay lab by commercial transport. Samples were crushed (< 7 kg) up to 90% passing 2mm (10 mesh), riffle split to 250 g and pulverized by mild steel to 95% passing 105μm (150 mesh). Samples splits underwent a 4-acid near total digestion followed by a multi-element analysis, including base metals, using an ICP method for 35 elements. Selected sample pulps were then analyzed for gold using a 30 g aliquot mixed with fire assay fluxes and Ag as a collector, placed in a fire clay crucible, gradually heated to 1060ºC for 60 min, and followed with an AA finish.

Laboratory QA/QC for the ICP analysis was 14% for each batch, including 5 method reagent blanks, 10 in-house controls, 10 samples duplicates, and 8 certified reference materials. An additional 13% QA/QC was performed as part of the instrumental analysis to ensure quality in the areas of instrumental drift. Laboratory quality control for the gold fire assay included two blanks per 42 samples, three sample duplicates and 2 certified reference materials, one high and one low (QC 7 out of 42 samples). In-house QA/QC included the systematic insertion of blanks, duplicates, and certified reference materials (CRM).

Qualified Person

Jeremy Niemi, P.Geo., Senior Vice President, Exploration and Evaluation for Sterling Metals has reviewed and approved the technical information presented herein.

About the Soo Copper Project

The Soo Copper Project sits just 20 minutes off the Trans-Canada Highway, one hour north of Sault Ste. Marie, and 20km from rail and deep-water access. With near-surface copper—one of the most critical of all critical metals—alongside gold, and with the project now demonstrating both scale and grade, Sterling sees the potential for Soo Copper to become a nationally significant asset as Canada accelerates its efforts to secure strategic copper resources. Prime Minister Carney’s recent designation of copper as one of Canada’s first five strategic assets underscores the importance of this discovery and its potential to emerge as a key project of national interest.

About Sterling Metals

Sterling Metals is a mineral exploration company focused on large scale and high-grade Canadian exploration opportunities. The Company is advancing the 25,000-hectare Soo Copper Project in Ontario which has past production, and multiple breccia and porphyry targets strategically located near robust infrastructure and the 29,000-hectare Adeline Project in Labrador which covers an entire sediment-hosted copper belt with significant silver credits. Both opportunities have demonstrated potential for important new copper discoveries, underscoring Sterling's commitment to pioneering exploration in mineral rich Canada.

Sterling Metals acknowledges that its exploration activities within the Soo Copper project are conducted on the traditional lands of the Batchewana, Garden River, and Michipicoten First Nations of the North Shore of Lake Superior. We recognize and respect the longstanding and diverse relationships Indigenous Peoples have with the land and are committed to engaging in a manner that is respectful, transparent, and inclusive.

For more information, please contact:

Sterling Metals Corp.

Mathew Wilson, CEO and Director

Tel: (416) 643-3887

Email: [email protected]

Website: www.sterlingmetals.ca

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release. This news release contains certain “forward-looking information” within the meaning of applicable securities laws. Forward looking information is frequently characterized by words such as “plan”, “expect”, “project”, “intend”, “believe”, “anticipate”, “estimate”, “may”, “will”, “would”, “potential”, “proposed” and other similar words, or statements that certain events or conditions “may” or “will” occur. These statements are only predictions. Forward-looking information is based on the opinions and estimates of management at the date the information is provided and is subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those projected in the forward-looking information. For a description of the risks and uncertainties facing the Company and its business and affairs, readers should refer to the Company’s Management’s Discussion and Analysis. The Company undertakes no obligation to update forward-looking information if circumstances or management’s estimates or opinions should change, unless required by law. The reader is cautioned not to place undue reliance on forward-looking information.